Proven Advocacy. Practical Solutions. Full-Scope Representation for Creditors in Connecticut.

At Neubert, Pepe & Monteith, P.C., our Creditor Rights Practice Group is a recognized leader in representing commercial creditors throughout Connecticut. We serve banks, credit unions, finance companies, loan servicers, asset-based lenders, and other institutional creditors in pursuing the full and timely recovery of debt. With a strong foundation in creditor rights law and a practical, results-oriented mindset, we combine time-tested legal strategies with modern technologies to drive recoveries and safeguard your financial interests.

At Neubert, Pepe & Monteith, P.C., our Creditor Rights Practice Group is a recognized leader in representing commercial creditors throughout Connecticut. We serve banks, credit unions, finance companies, loan servicers, asset-based lenders, and other institutional creditors in pursuing the full and timely recovery of debt. With a strong foundation in creditor rights law and a practical, results-oriented mindset, we combine time-tested legal strategies with modern technologies to drive recoveries and safeguard your financial interests.

Deep Experience. Comprehensive Services. Strategic Execution. Modern Approach.

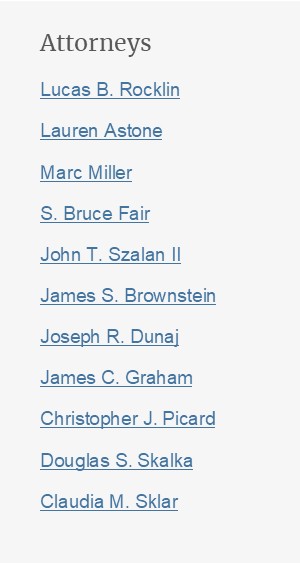

Our attorneys bring decades of combined experience across a wide range of creditor-side matters. Whether the obligation is commercial or consumer in nature, we apply a compliance-focused, results-driven approach to every engagement.

We provide comprehensive creditor representation, from pre-default advisement to post-judgment recovery, across state and federal courts, bankruptcy proceedings, and administrative forums. Our team is well versed in both the intricacies of consumer protection laws and the complex legal structures that govern secured lending, commercial collections, and enforcement actions.

Grounded in a tradition of legal excellence and aligned with contemporary practice standards, we deliver counsel that is principled, efficient, and responsive. Our attorneys combine sound legal judgment with practical business insight to meet the evolving needs of today’s financial institutions.

Our legal services include:

Trial Litigation Services

We provide disciplined, trial-ready representation for lenders and creditors in high-stakes commercial disputes, secured-transaction litigation, guaranty enforcement matters, and contested foreclosures. Our approach integrates strategic pre-trial planning, focused evidence development, and precise courtroom advocacy to protect collateral, eliminate exposure, and secure enforceable judgments. From case assessment through post-trial enforcement, we deliver practical, results-driven litigation aligned with each client’s commercial objectives.

Foreclosure Representation

We represent lenders, servicers, and creditors in all aspects of Connecticut foreclosure litigation, delivering strategic, enforcement-focused counsel that protects collateral and drives efficient recovery. Our team manages the full foreclosure lifecycle, including compliance, mediation, summary judgment, trial advocacy, receiverships, assignments of rents, replevin coordination, and deficiency judgment proceedings. We approach each matter with commercial discipline and legal precision, ensuring timely, effective enforcement across residential and commercial properties.

Personal Property Collection and Recovery

We assist lenders and secured creditors in recovering personal property and enforcing their security interests through replevin actions, UCC Article 9 sales, conversion claims, and civil theft litigation. Our team acts with urgency and precision to locate, secure, and repossess equipment, inventory, machinery, and other collateral before it is moved, concealed, or depleted. We combine disciplined litigation strategy with practical commercial judgment to preserve asset value and maximize recovery.

Prejudgment Remedy (PJR) Attachments

We help creditors secure prejudgment attachments under Connecticut law to preserve assets and strengthen recovery before a final judgment is entered. Our team evaluates the appropriate statutory pathway, whether through noticed hearings, ex parte applications, or contractual waivers, and acts quickly to attach bank accounts, real estate, equipment, and other assets that might otherwise be concealed or dissipated. By obtaining early judicial intervention and asset control, we enhance settlement leverage, protect priority, and position clients for efficient and enforceable recovery.

Settlement and Workout Services

We provide lenders and creditors with strategic, business-aligned resolution options that minimize litigation risk and maximize recovery. Our team negotiates and structures tailored settlements, loan modifications, forbearance agreements, deeds in lieu, friendly foreclosures, and stipulated judgments, each designed to deliver efficient, enforceable outcomes. We approach every workout with commercial discipline, precision drafting, and a clear focus on practical, cost-effective resolution.

Judgment Enforcement and Collection

We represent creditors in all phases of post-judgment enforcement, using bank executions, wage garnishments, liens, property seizures, subpoenas, and turnover orders to convert judgments into actual recoveries. Our approach is disciplined, strategic, and focused on identifying debtor assets quickly, enforcing rights efficiently, and maximizing return. Whether the judgment originates in Connecticut or is domesticated from another state, we deliver targeted, results-driven recovery solutions.

Domestication and Enforcement of Foreign Judgments

We assist out-of-state and international creditors in domesticating and enforcing judgments against debtors with assets or business operations in Connecticut. Our team handles all aspects of domestication under the Uniform Enforcement of Foreign Judgments Act and Connecticut common law, followed by targeted post-judgment enforcement using bank and wage executions, liens, property seizures, and discovery tools. We deliver disciplined, results-focused strategies that convert outside judgments into enforceable Connecticut recoveries.

Landlord Representation: Evictions and Rent Collection

We provide landlords with decisive, compliance-focused representation in eviction proceedings, rent collection actions, and lease enforcement matters. Our team manages the entire process with precision, from Notices to Quit and Summary Process litigation to post-judgment recovery, ensuring efficient restoration of possession and recovery of unpaid rent. We also offer proactive counsel to reduce legal exposure and strengthen long-term property operations.

Appellate Representation for Creditors

We provide disciplined, creditor-focused appellate advocacy designed to protect judgments, correct legal error, and safeguard enforcement outcomes. We manage the full appellate process, from issue preservation and briefing to oral argument and post-judgment motion practice, with strategies grounded in procedural precision and commercial judgment. Our approach ensures creditor rights remain protected through every phase of appellate review.

Bankruptcy Representation for Creditors

We represent lenders and creditors in all aspects of bankruptcy litigation, protecting secured and unsecured claims through strategic action, timely filings, and disciplined enforcement. Our team handles relief from stay motions, nondischargeability actions, plan objections, preference and fraudulent transfer defense, and dismissal or conversion efforts to safeguard collateral and maximize recovery. We deliver responsive, commercially focused advocacy that preserves creditor rights from petition through discharge.

Merchant Cash Advance (MCA) Enforcement and Compliance

We represent MCA funders in all phases of enforcement, litigation, contract recovery, and regulatory compliance, delivering disciplined and commercially focused solutions to protect receivables and secure payment. Our team leverages Connecticut’s creditor-friendly statutes to obtain prejudgment attachments, redirect receivables, litigate defaults, negotiate structured settlements, and convert judgments into tangible recoveries. We also assist funders with contract drafting, compliance audits, and nationwide enforcement strategy to minimize risk and strengthen long-term recoverability.

Contact Our Creditor Rights Practice Group

Attorney Lucas Rocklin leads the practice with deep experience in both commercial and consumer creditor rights law. Known for his strategic thinking and results-oriented execution, he is a trusted advisor to financial institutions and creditors throughout Connecticut. We welcome the opportunity to assist you.

Lucas Rocklin, Chair, Creditor Rights Practice, Neubert, Pepe & Monteith, P.C.

📧 Email: lrocklin@npmlaw.com

📞 Phone: (203) 781-2835

📅 Virtual Meeting: Book a 15-minute consultation

We are committed to delivering disciplined, strategic litigation services designed to protect your financial interests and secure meaningful recovery.